A Q&A with the auction winner of Jalen Suggs' NFT

'That late bid gives me confidence that the market for the NFT/Suggs shoes is potentially higher than the $10K I paid'

Welcome back to Out of Bounds, a free, weekly newsletter about college athletics. Feedback, tips and story ideas are always welcome at andrew.wittry@gmail.com or you can connect with me on Twitter.

Two or three months ago, I’m not sure I could’ve told you what the acronym NFT stands for (non-fungible token), what an NFT is, exactly, or why the market for NFTs has seemingly exploded. I doubt I’m alone in that sentiment.

NFTs and college athletics intersected when men’s basketball consensus national player of the year Luka Garza commissioned an NFT in April, becoming what is believed to be the first athlete in college to do so. Garza put the one-of-one Luka Garza Consensus National Player of the Year Card up for sale in an online, cryptocurrency auction using the platform OpenSea.

Before the auction closed, Garza’s father, Frank, told me they would like to launch a series of 55 NFTs in honor of Luka Garza’s jersey number at Iowa and this week, Garza launched the Luka Garza NFT Group, which is “a groundbreaking non-fungible token marketplace with a mission to help college artists, athletes, musicians, and students to monetize their Name, Image, and Likeness (NIL),” according to the group’s website.

“It’s not a zero-sum game in our opinion,” Frank Garza said of athletes monetizing their NIL rights. “Someone doesn’t have to lose for athletes to win. No! We look at it like an infinite solution. It’s not finite, it’s infinite. Create more revenue.”

And that’s how you end up spending two hours on a Friday night refreshing your browser every few minutes in order to watch two anonymous bidders compete in an online auction, while sipping on a Yuengling and looking up the latest currency conversion rates for a cryptocurrency that you had only learned of that day. As the name suggests, much of the value of an NFT is derived from it being unique, similar to a one-of-a-kind piece of art; “non-fungible” means an item can’t be replaced or substituted with an interchangeable version of the item, such as how a $1 bill carries the same value as another $1 bill.

For today’s newsletter, in order to better understand the NFT marketplace, what is driving the demand for NFTs and what the future of NFTs might look like, I conducted a Q&A with someone who hasn’t just participated in an online auction for a recent men’s college basketball player’s NFT, but who has actually won one.

What you need to know

Here are the highlights from today’s newsletter:

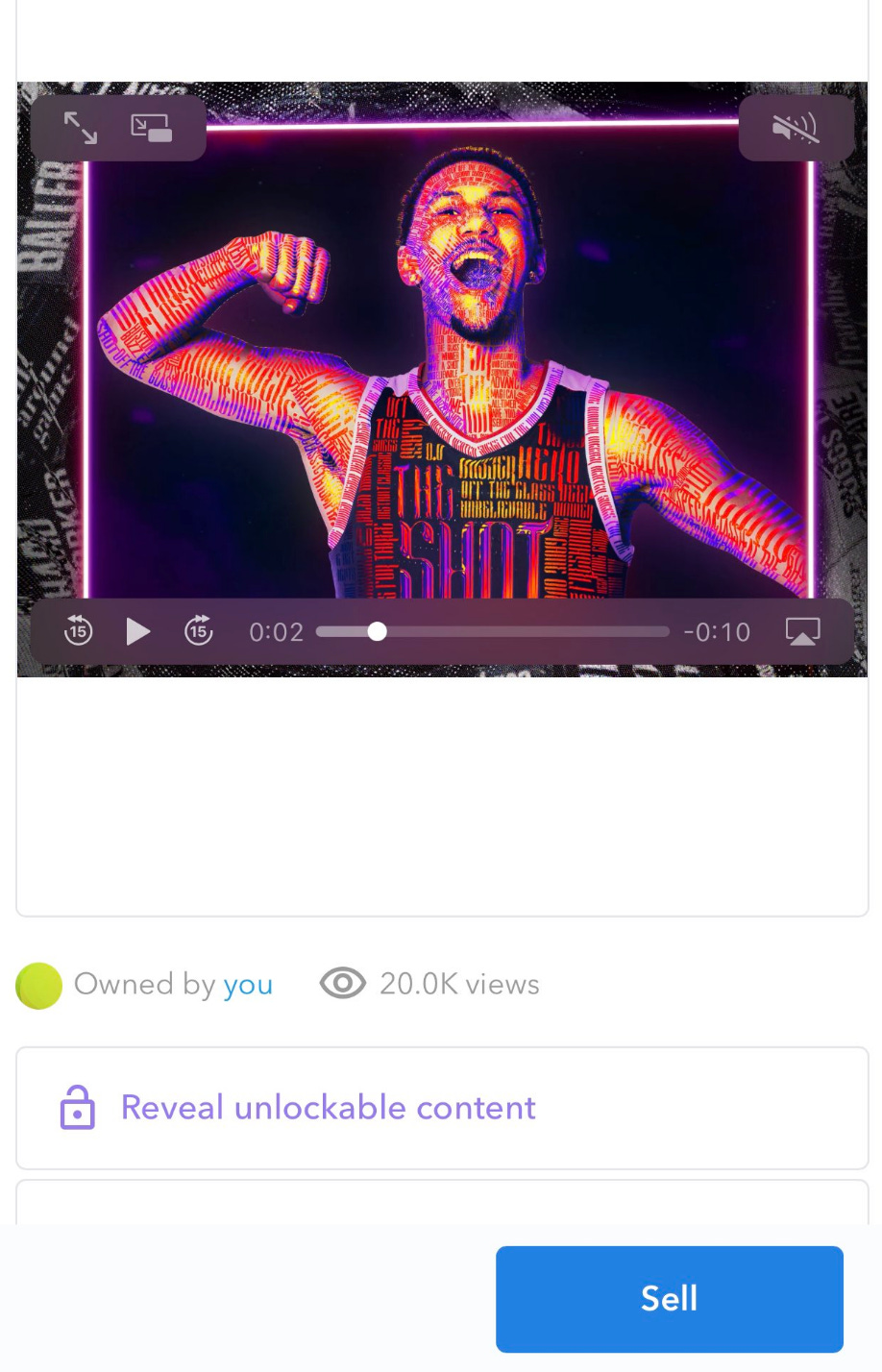

Iowa’s Luka Garza recently auctioned off an NFT, along with physical memorabilia and in-person experiences, which was a model that one-and-done stars such as USC’s Evan Mobley and Gonzaga’s Jalen Suggs followed. Suggs branded his NFT as “Jalen Suggs: The Shot” in honor of his game-winning 3-pointer against UCLA in the Final Four.

The winner of the auction for Suggs’ NFT told me, “I don’t plan on trying to flip this for a quick profit unless I get an offer that blows me away.” Oddly, the bidding for Suggs’ NFT became less competitive as the auction progressed and Suggs’ NFT sold for the equivalent of roughly $10,439, which was significantly less than the winning bid for Garza’s NFT package (roughly $41,141) but more than the bid that won Mobley’s NFT (roughly $4,600).

Due to licensing constraints, Suggs’ NFT doesn’t include a video highlight of his game-winning shot (or any other university or NCAA marks), which is different from the offerings available on NBA Top Shot. The owner of Suggs’ NFT said, “I can’t imagine that the auction wouldn’t have been six figures if the shot itself was the NFT.”

OpenSea is the platform where Iowa’s Luka Garza, USC standout Evan Mobley and Gonzaga point guard Jalen Suggs have auctioned off their NFTs, along with physical memorabilia, such as a signed pair of shoes or a signed jersey, and in-person experiences, such as a meet-and-greet. Mobley and Suggs announced the sale of their NFTs on Twitter in conjunction with their announcements that they were declaring for the NBA draft.

OpenSea user BFD050 won Suggs’ NFT on April 22 with a winning bid of 4.1265 wrapped Ethereum (WETH), which is a cryptocurrency whose value at the time the auction closed placed the winning bid at the equivalent of roughly $10,439. The following is a Q&A with the winner of Suggs’ auction, who has been granted anonymity in exchange for his honest insight into the NFT marketplace.

He provided additional proof that he did indeed win the auction:

Out of Bounds started by asking about the auction winner’s age and industry, as well as his experience bidding for Suggs’ NFT and winning. The following Q&A has been lightly edited for clarity.

BFD050: I’m in my late 20s, I worked in media ad sales and now I do media consulting.

In terms of the auction process it was pretty smooth for me. I didn’t really understand the strategy of the other bidders. They were bidding up the item with several hours to go and then all dropped out after someone basically doubled the bid to $10K with 45 minutes left. I put my 5% higher bid in at 11 minutes left and was surprised nobody outbid that. Someone did try to come in at the last second with a bid of 6 [Ethereum] ($15.5K at the time I believe), but they were late by seconds. That late bid gives me confidence that the market for the NFT/Suggs shoes is potentially higher than the $10K I paid.

I don’t plan on trying to flip this for a quick profit unless I get an offer that blows me away. For me buying this NFT was about owning an amazing piece of CBB history. It’s one of the top NCAA games of all time and [in my opinion] is a top-five made March Madness shot ever. Also I’m a huge fan of Suggs and his pro potential.

Out of Bounds: How would you describe your sports fandom and what has been your financial investment in sports, whether it's sports gambling, fantasy, tickets or memorabilia?

BFD050: I am a massive sports fan, in particular basketball. It’s been a passion of mine throughout my life. In terms of financial investment in sports this is really my first significant purchase in the space. I own some [NBA Top Shot moments] and physical memorabilia like autographed balls and photos, but nothing worth more than a couple hundred dollars. I don’t do daily fantasy. I gamble on sports with friends, but most of my gambling is poker.

Out of Bounds: What has been your experience with NBA Top Shot? If the NCAA and all of its members and broadcast partners could figure out the licensing, could you envision a college version?

BFD050: I wasn’t an early adopter in [NBA Top Shot] so my experience has mostly been missing out on packs. I have high regard for Dapper Labs and what they have built thus far with [NBA Top Shot] especially when you consider trying to accommodate massive user growth in a short span.

Whatever anyone may think of the NCAA and their exploitation of athletes they aren’t dumb. If there is money to be made in tokenizing moments they own they will do it. I expect there will be an NCAA version of NBA Top Shot within the next 2-3 years.

My personal favorite company/product in the NFT sports space is [digital horse-racing platform] ZED RUN. I have zero money invested in it at this time, but they’ve figured out how to gamify their NFTs which I think has a more addressable market than collectibles/art.

Out of Bounds: I was interested to see the market for Suggs' NFT since he had branded it as "Jalen Suggs: The Shot" but it didn't include the actual highlight, given the current licensing constraints. How much greater do you think the winning bid could've been if it was like Top Shot and included the replay of his shot, and how much do you think the other items in some of these auctions, such as signed shoes or jerseys, or meet-and-greets with players can affect the demand?

BFD050: I think a Top Shot-style 1-of-1 NFT of the shot would be worth six figures. Despite not winning the final you’re talking about one of the best teams this decade, playing in one of the best games this century, winning on a buzzer beater in OT that’s one of the best five shots in NCAA tournament history. I’m not the right person to judge true value, but I can’t imagine that the auction wouldn’t have been six figures if the shot itself was the NFT.

My assumption is the physical asset is a bigger draw as long as it’s something of legitimate value. In particular in this case where it’s a signed pair of shoes from the game that’s got real significant value it’s going to bring in more bidders. I think it’s a mistake to write off the NFT as a simple tool to sell the shoes. If Jalen becomes the All-Star level player many believe he will then owning the first-ever NFT he released will have value [in my opinion]. The physical add-ons open up the bidding process to people who would otherwise not bid on the NFT, so I think it’s smart for players to bring together people who are into NFTs and physical collectors to increase demand.

When I looked at valuing these shoes I looked at the pair of Zion [Williamson] shoes from Duke that sold for $20K, I looked at auction prices in the past for meet-and-greets with players that go around $1,500-$10K. Various other auctions for signed memorabilia validated my thesis on price.

Out of Bounds: I agree, I think whoever won Evan Mobley's NFT package for 2.1 ETH, or roughly $4,600, may have gotten a steal for his first NFT, a signed college jersey, a signed pro jersey and two tickets to an NBA game to meet him in person. If he's an All-Star caliber player in the future, a signed jersey or a meet-and-greet alone could be worth $4k, let alone the whole package.

It sounds like you're not actively trying to flip Suggs' NFT for a profit right now, so will you try to display it somewhere? There's rare artwork that's locked up in storage units, so not every collector's item has to be displayed but do you think there will be man caves in the future with iPads showing off NFTs? Do fans have who want to own them and not flip them just have to subtly mention that they own them in conversations? I'm curious about what that's like for NFT owners, especially those that spent six figures on one.

BFD050: I was monitoring the Mobley auction, I was surprised it didn’t go for more, but none of the items outside of the NFT itself are truly 1-of-1, which I think depressed the price. I do plan to display my NFTs, but at this point in time I don’t like any of the current hardware for that. Hopefully over the next 1-2 years there are better options for displaying NFTs. I’d love to put the shoes and NFT together in some kind of display.

I’ve only told a couple close friends that I bought the NFT and unless I’m having a conversation where it comes up generically I don’t plan on sharing that I am the owner. Once I can display it then it will of course be a little more open.

One thing I want to be sure I clarify is I view my purchase in USD not ETH. So if the price of ETH goes up to $10K and I sold it for 2 ETH I wouldn’t consider that a loss and same for if I sold it for 100 ETH but the price [of Ethereum] was $50 I’d consider that a loss.

Out of Bounds: For these auctions, it's interesting that if the winners want to sell an NFT, they'll have to monitor both the player's career and the value of the cryptocurrency in order to judge the value of it and what trajectory it's on. Anything else you want to add about NFTs, crypto or athletes finding new ways to monetize their brands?

BFD050: You can't bid in dollars, but once I had my price locked in and went and bought that same amount of [Ethereum], so the way I see it I spent $10.4K not 4.1 ETH.

The only thing I would add that I am monitoring in the space is, are athletes and to the same degree celebrities trying to make a cash grab or launching NFTs strategically and carefully?

A common mistake in my opinion I am seeing are celebs launching 100+ NFTs and assuming there will be a market for it both now and in the future. In my opinion that’s a mistake. You should be trying to create artificial scarcity by only having so many of these out there.

One way to do this as we have seen with Jalen, Garza, and Mobley is tying these to physical assets or experiences. I think going forward athletes and celebrities should be combining experiences with NFTs. [EDM duo] Adventure Club tried this with lifetime VIP passes to their concerts and a chance to collab with them. I think those make the NFT more valuable and are more likely to maintain value in the long term versus many of the cash grabs we currently see.

I feel like you probably agree with that sentiment, but I've had conversations with too many people who just want to grab whatever they can find and think they will be able to flip it in 3-6 months for serious profit.

In case you missed the last newsletter

(Click the image below to read)

“[AVCA President and Butler University head coach] Sharon Clark emphasized volleyball coaches have a window of opportunity to make their voices heard right now,” Jones wrote. “She noted the NCAA won’t change without hearing from the membership meaning conferences and institutions. We need to move beyond comparing women’s and men’s sports. The focus needs to be on female student-athletes and their sports being respected and promoted with the potential they have to be bigger and better.”

Read the full newsletter here.

Thank you for reading this edition of Out of Bounds with Andy Wittry. If you enjoyed it, please consider sharing it on social media or sending it to a friend or colleague. Questions, comments and feedback are welcome at andrew.wittry@gmail.com or on Twitter.